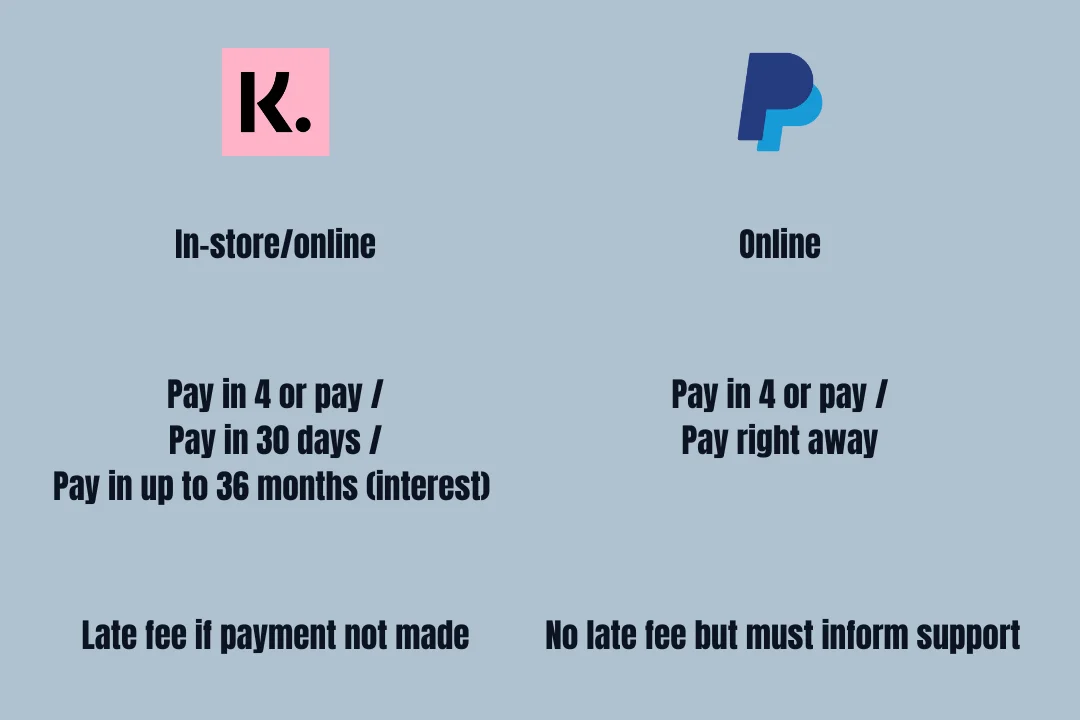

Klarna is a buy now, pay later app that supports online and in-store shopping. PayPal is a payment processing system but has buy now and pay later features.

The debate between Klarna vs. PayPal has never been more serious until now. So, let’s get into it.

What are both

Klarna is a buy now, pay later app that lets you shop in stores and pay in either four equal payments, pay within 30 days, or pay in up to 36 months. The latter two options are not available everywhere.

PayPal lets you pay online with your credit card, but you can choose the “Pay in 4” option for many products and pay in four installments.

Signing up

Klarna

Klarna offers an easy way to sign up. You can provide your email and phone number for the initial account setup. After the setup, you can browse the app and check its features.

While making the first purchase, the app requires adding a card or a bank account to verify your payout method.

PayPal

PayPal is more strict than Klarna. The initial sign-up process requires the following:

- Legal name

- Address

- Credit, debit, or bank account

- Phone number

PayPal charges a small fee to verify your payment option. Also, for major transactions, you might need to verify your identity by providing legal documents.

How do both work

Klarna

Klarna supports both websites and stores where Visa is accepted.

You can use the Klarna app, which has a built-in browser to shop online. In the app’s browser, you will continue shopping normally.

The app has a Klarna Pay” button that generates a one-time card to pay. That card gets deactivated after the purchase.

To use it in-store, you need an NFC-enabled device and a payment app such as Google Wallet (Pay) or Apple Pay.

In the Klarna app, an option called “In-store” lets you create a card and add it to the payment app. Then you use that card to pay.

I have written a whole article and made a video on using the Klarna app. Check it out if you want a fully detailed tutorial.

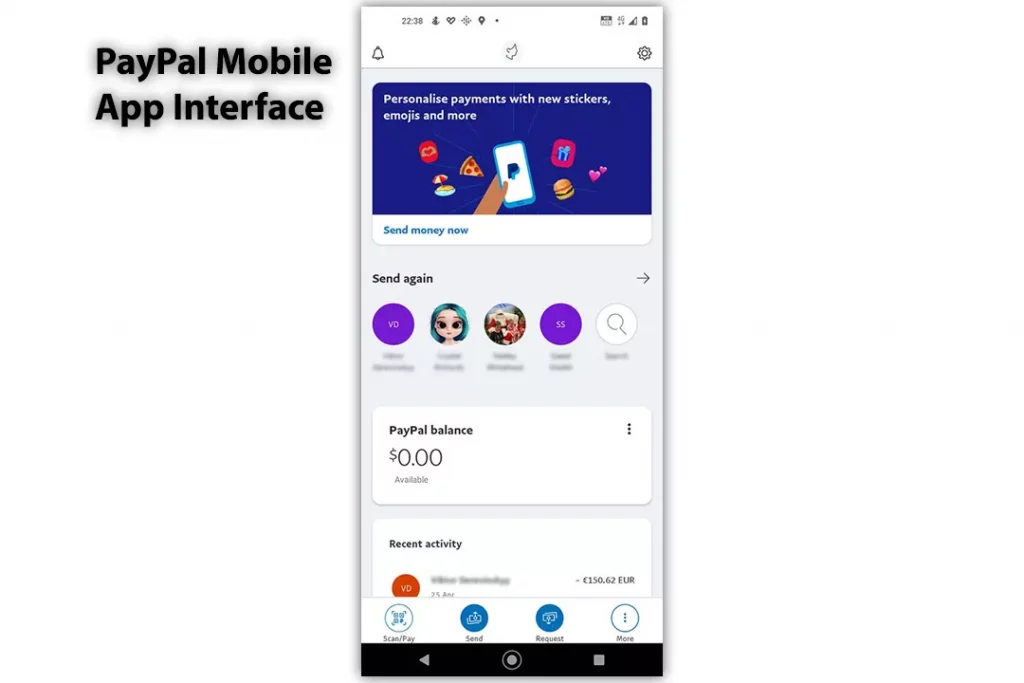

PayPal

PayPal is supported in millions of stores. While paying for the product, you will be asked to use the “Pay in 4” option.

The screen will show all the necessary options if you choose to pay in 4.

Related: Afterpay vs. PayPal

Country Availability

Klarna is available in 17 countries as of writing this post. Here is the full list:

- Australia

- Austria

- Belgium

- Canada

- Denmark

- Finland

- France

- Germany

- Italy

- The Netherlands

- New Zealand

- Norway

- Spain

- Sweden

- Switzerland

- US

- UK

PayPal, on the other hand, is available in many countries. Like Klarna, some of its features are country-dependent, including the “Pay in 4”, so if you live in an unsupported region, you might not have this option.

Return and late fees

The last part of this Klarna vs. PayPal battle is the returns and late fees. With Klarna, if you return something, you should inform the team.

You can go to your purchases in the app and click on the report a return button.

In terms of late fees, Klarna is location-dependent. If you miss a payment in Australia, you are charged $3 to $15. The fee depends on the total order value; you pay $15 if the order value is over $200.

If you miss a payment in the UK, you might be eligible to request a 7 to 10 days extension. If the same keeps happening, the company may deactivate your account.

With PayPal, it’s different. You return the item, and the seller returns the money. The money goes to your PayPal account or the actual card or bank account you used to pay.

PayPal does not charge a late fee, but you must inform PayPal support if you can’t make the payment. The app also does not charge you any interest.

Payment extension

With Klarna, you can request to change the payment date, but it costs a couple of dollars. In Australia, the fee is $3.

As mentioned, PayPal has no option for the late fee, so there is no option for extending the payment date.

Related: 9 Best Apps Like Klarna Supporting Most Brands

Which one is for you?

Klarna is quick and fast. If you have never used PayPal or Klarna, I suggest going with Klarna.

Creating a PayPal account takes time, and after a certain limit, you must verify your account by providing legal documents.

If you just want a buy now, pay later app, Klarna is the right choice.

Klarna vs. PayPal: Links

Summary

The right payment method is essential for a faster payment process and maximum savings.

Klarna and PayPal are good choices, and in the end, I suggest having both options and using the favorite wherever possible.

Anyway, here we end this Klarna vs. PayPal comparison. I hope the article helped you understand both and pick the most beneficial app. Please let me know your views and suggestions in the comments below.

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.

🙏 thank you

No worries.