Both Afterpay and PayPal are world-leading payment processing services. Both offer the buy now, pay later features, but which one is for you?

This is the Afterpay vs. PayPal battle to help you find the best.

What are both

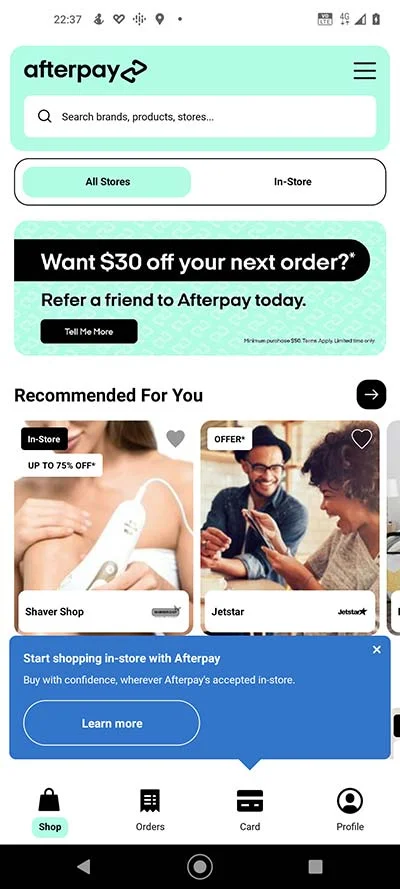

Afterpay is a buy now, pay later app that lets you buy items and pay in four equal installments. The first installment you pay to Afterpay is either the first day of the shop or after two weeks, depending on your status.

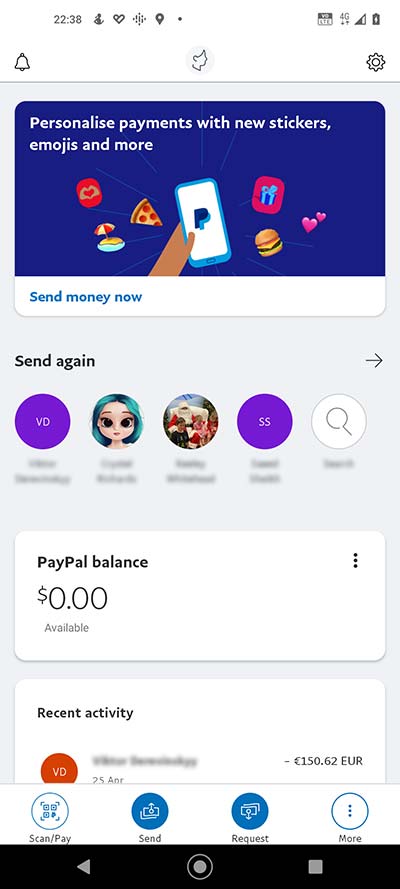

PayPal is not entirely like Afterpay because it is for paying the amount in full, but it has a service titled Pay in 4 that lets you pay for the items in four equal fortnightly payments.

Both do not charge internet; however, Afterpay charges a $10 fee if the payment is not made on a required day.

PayPal does not charge a late fee, but one must contact the support if they can’t make a payment,

While you are here, browse Klarna versus PayPal

Signing up

Both can be accessed through their websites or their apps. Signing up for both platforms is easy.

Afterpay

To sign up on Afterpay, you need your email, phone number, and a credit card for repayments.

PayPal

PayPal lets you create an account if you have an email and a credit or debit card. However, you must verify if the amount in your account exceeds a certain limit.

When you add a card or bank account, both apps may charge a small amount to verify your account.

How to use both

Using Afterpay requires the Afterpay app. To shop online, choose the Afterpay option at checkout and log in with your Afterpay account.

To use it in-store, you must have an NFC-enabled device. In the Afterpay app, you will generate a card and add it to the payment app.

You will go to the Afterpay app and activate the card to use it using the payment app (Google Wallet or Apple Pay).

PayPal is only online, so you can choose the PayPal option at the checkout and choose the “Pay in 4” option. Read the terms and stuff and pay using the “Pay in 4” option.

Before you go: Klarna or Afterpay

Country availability

The next part of Afterpay vs. PayPal is availability. Though transactions are made online with Afterpay and Paypal, their services are only limited to certain countries. Afterpay is available in:

- Australia

- New Zealand

- US

- UK

- France

- Spain

- Canada

PayPal serves in more than 200 countries. Offered services vary in the country. Some countries can send and receive payments and automatic transfers, and some can’t.

Payment frequency

For both, you pay the first payment on the day of the purchase. The rest payments are every fortnight.

With Afterpay, if you are on the Mint Reward level, you pay the first installment after two weeks. Although Afterpay has a down payment, on Mint, it becomes an app without a down payment.

How much money do you get

Afterpay gives you an initial limit of around $350. As you use it, the limit increases. Users can score up to $2,000 to shop.

Also, if a product costs more than the limit, you can use a credit or debit card for the rest of the payment.

PayPal gives you up to $2,000 to shop and pay in 4 installments. This may be different based on your country.

Returns and late fees

There are a few differences when it comes to the late fee. With Afterpay, it’s usually $10, but if the order value is higher, the fee can be up to 25% of the installment.

There is no late feed with PayPal, and it does not charge interest, but you must let the support know that you can’t make the payment.

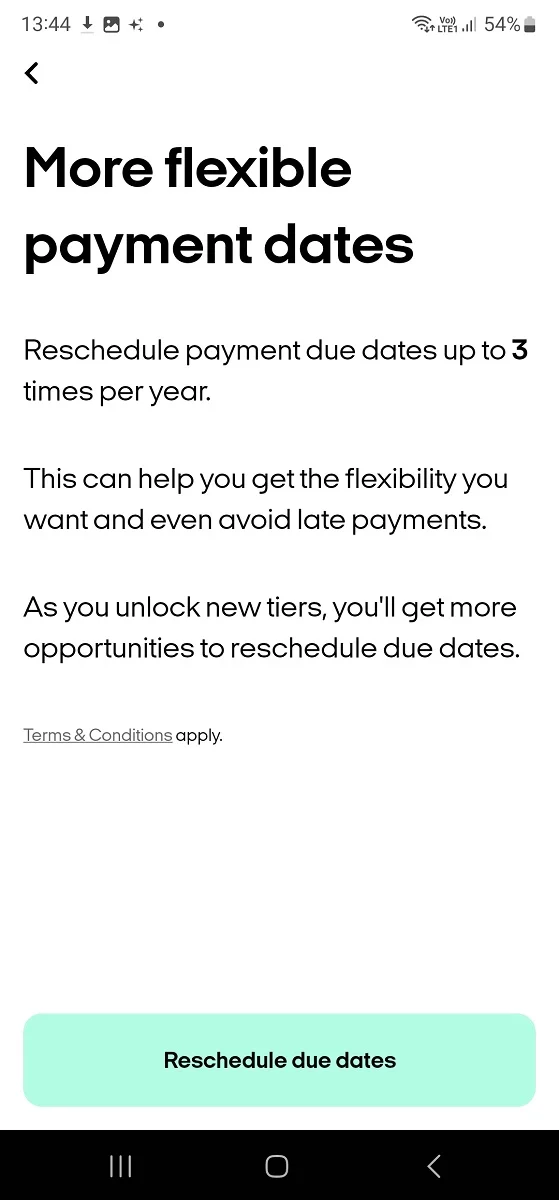

Extending payment date

Afterpay has rewards, and based on your reward status, you can extend payment dates. With the Gold and upper memberships, you can spread the second and third payments.

The first and last payments can’t be changed. Furthermore, depending on your status, there is a certain limit on how many times you can change the date per year.

With PayPal, as discussed, you must contact the PayPal support team to request a payment extension.

Summary

Afterpay is especially for buy now, pay let, whereas PayPal is for payments as buy now, pay later services.

Both are fine, but I suggest using Afterpay if you want a buy now, pay later app. PayPal has many terms and conditions and limitations, and not following those can terminate your account.

Although terminations of buyer accounts are rare, it happens.

With Afterpay, you pay the $10 fee, but terminations are very rare. Afterpay is a great BNPL app without affecting your credit score.

Afterpay vs. PayPal: Links

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.