Credit score has become a significant number following us wherever we discuss money. Keeping it healthy is the only viable solution.

Some buy now, pay later apps also keep track of this score. This is why it’s always good to use the buy now, pay later apps with no hard credit check. The article is all about those apps.

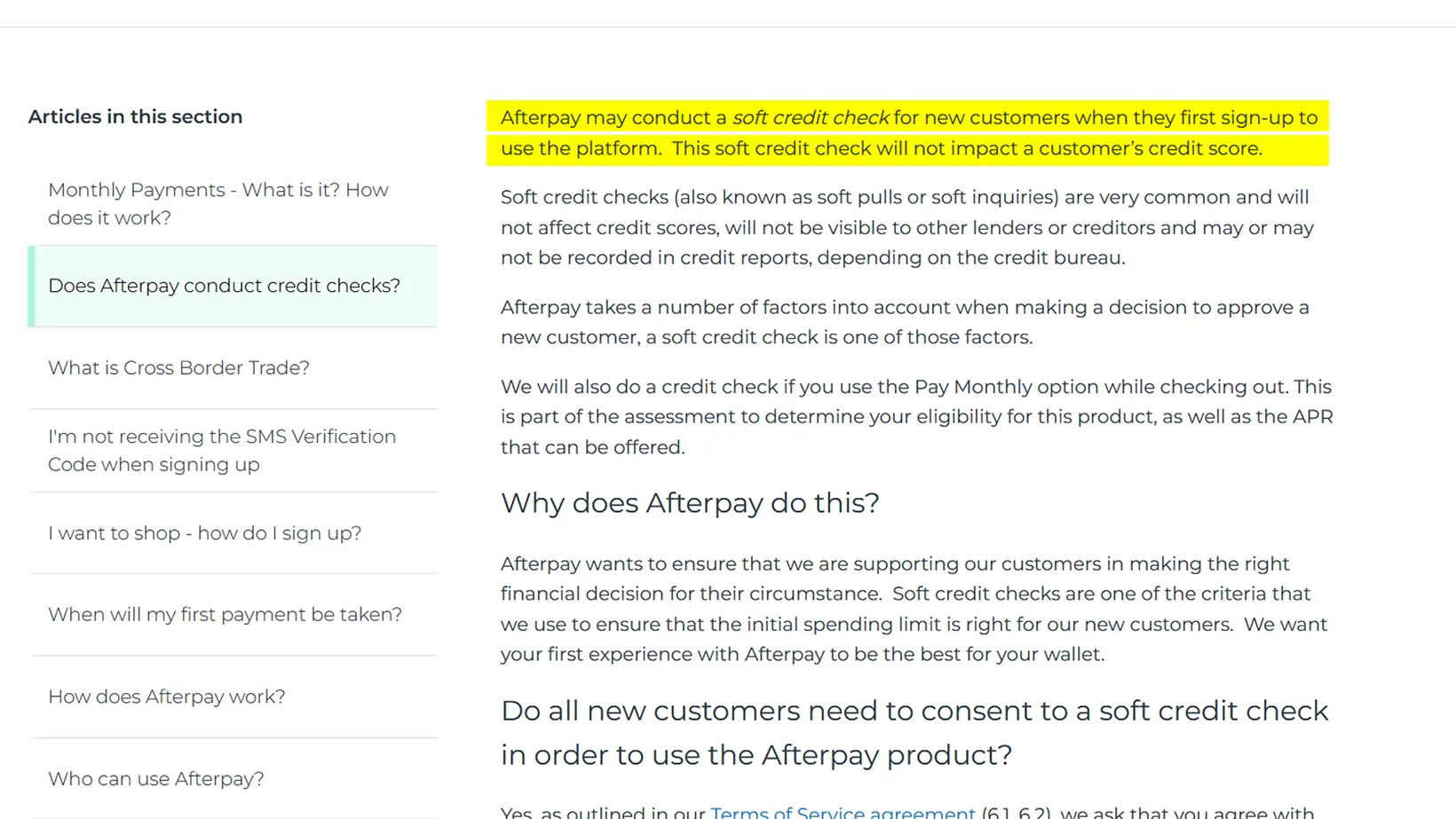

Afterpay

Afterpay is probably the best buy now, pay later app with no hard credit checks. It does a soft credit check when you sign up.

It does not recheck your score if you choose the fortnight option while shopping.

It treats all customers equally by giving a similar spending limit initially. As long as the 25% first installment and the rest are paid on time, your relationship with Afterpay is solid.

Paying back on time is the best way to increase your limit. Not paying on time will cost you a fee and, in some cases, account restrictions, but it has no effect on your credit score.

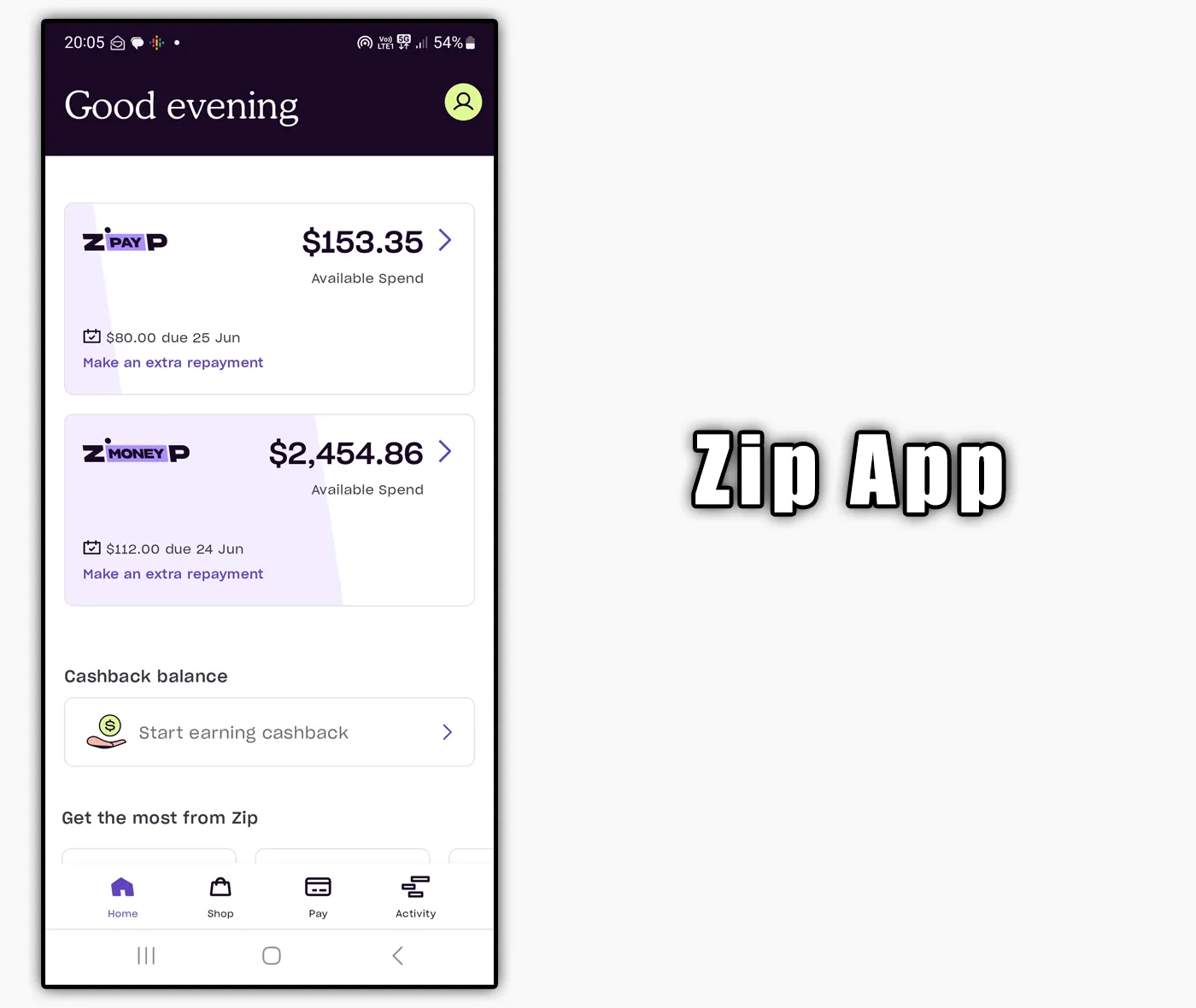

Zip Pay

Another app that does not affect your score is Zip Pay. Zip has two services: Zip Pay and Money.

Zip Pay is an ordinary app that gives you money to spend and pay later. It does a soft credit check to see your spending power.

Zip Money is an interest-based service that lends more money, but if the minimum is not paid before the due time, your account is scored and reported.

Zip Pay is also one of those apps without any down payment, so you can use the app and pay the money later.

It gives you 30 days and lets you choose the payment date, frequency, and total payment.

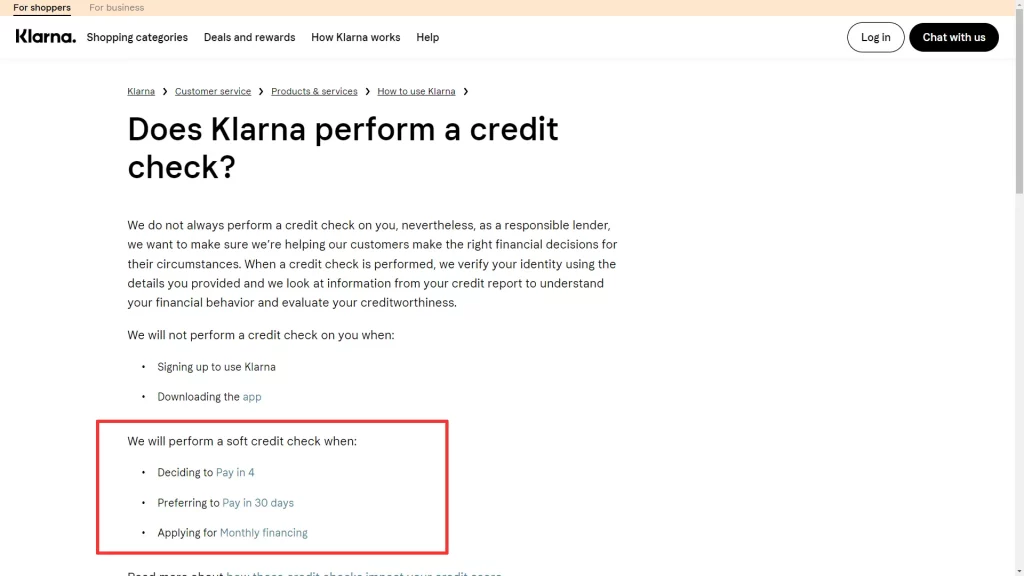

Klarna

Klarna does not do a credit check when you sign up. It, however, does a soft credit check every time you use it.

The soft credit check involves charging you a 25% payment upfront. This ensures that you have enough to repay. The soft check may also include checking your current credit score.

If you don’t repay on time, the app may put some restrictions on your account, but they never share your account status with anyone.

Check out: Klarna vs. Afterpay

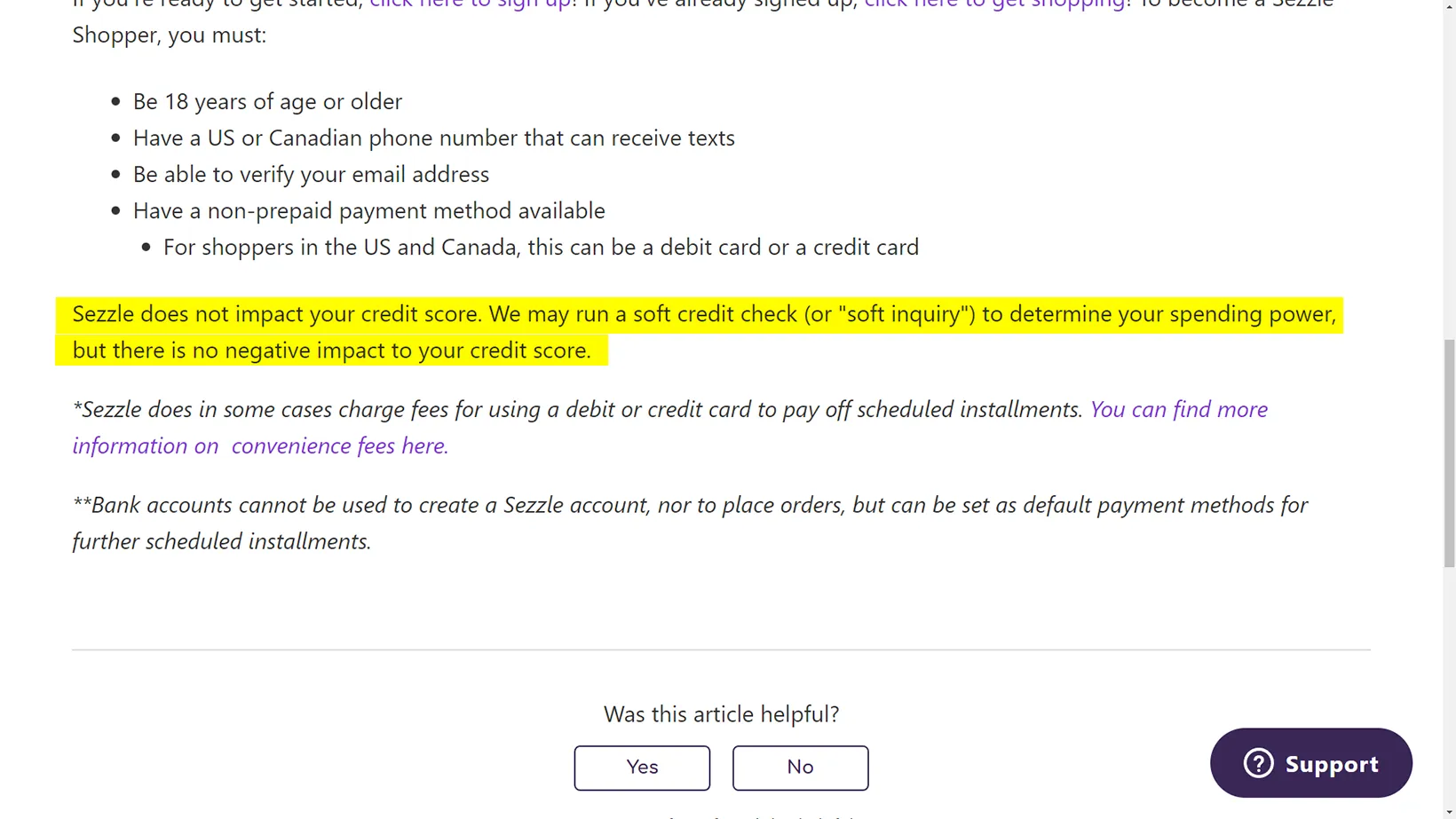

Sezzle

Sezzle is an ordinary buy now, pay later app that does not affect your credit score. Like other services, it does a soft check to confirm your spending power.

Not paying on time will affect your Sezzle account, but credit organizations won’t know anything about it.

Sezzle gives you six weeks to pay, where the first payment is the day of the shopping, and the rest are biweekly.

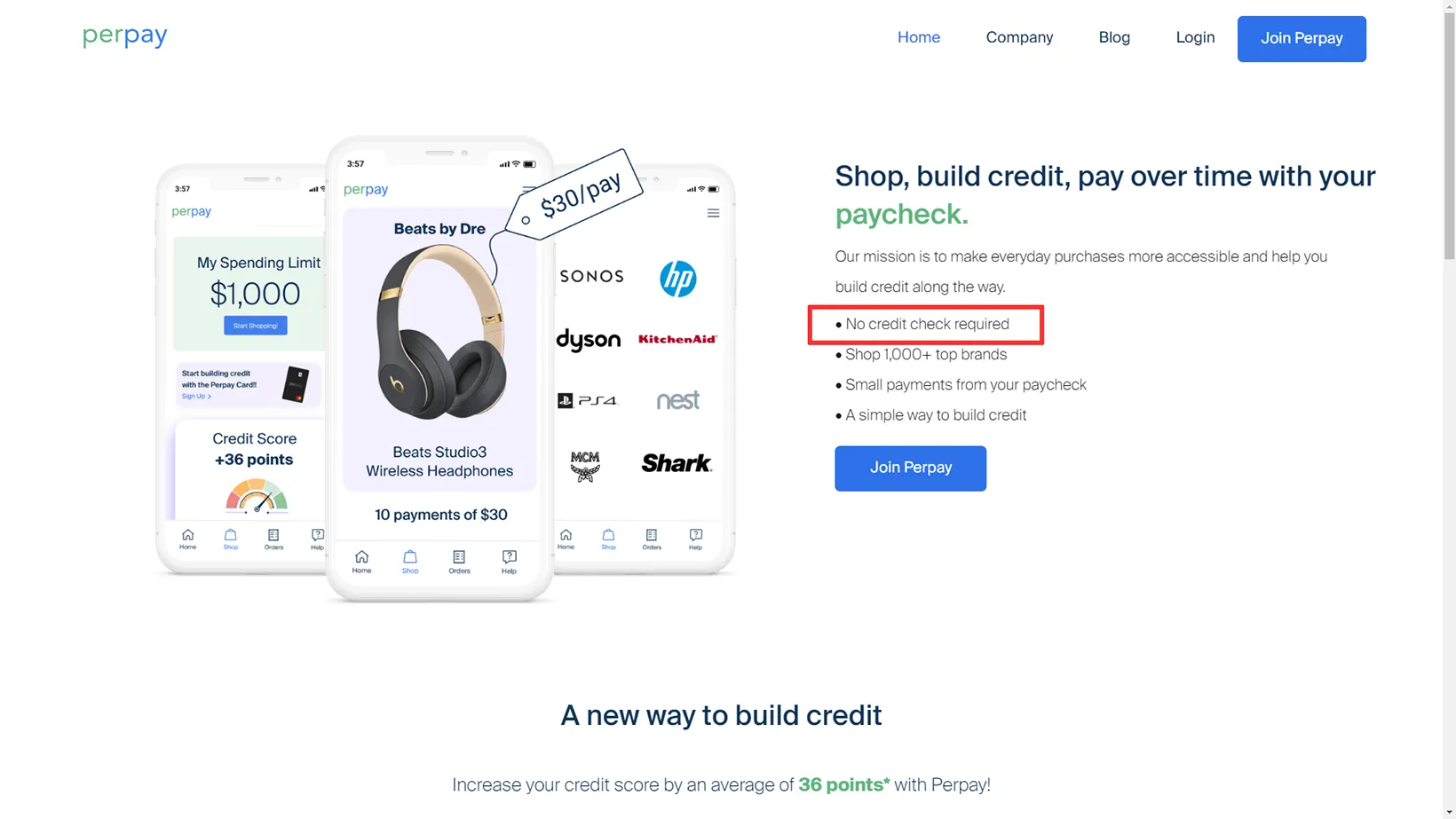

Perpay

Another one of the great buy now, pay later apps with no credit impact is Perpay. Perpay is amazing for two reasons:

- It charges you the first payment on your payday. So, you can shop anytime you like.

- It does not check your score; if you keep paying on time, it helps you build it.

Perpay depends on your profile and current income to determine your spending capacity.

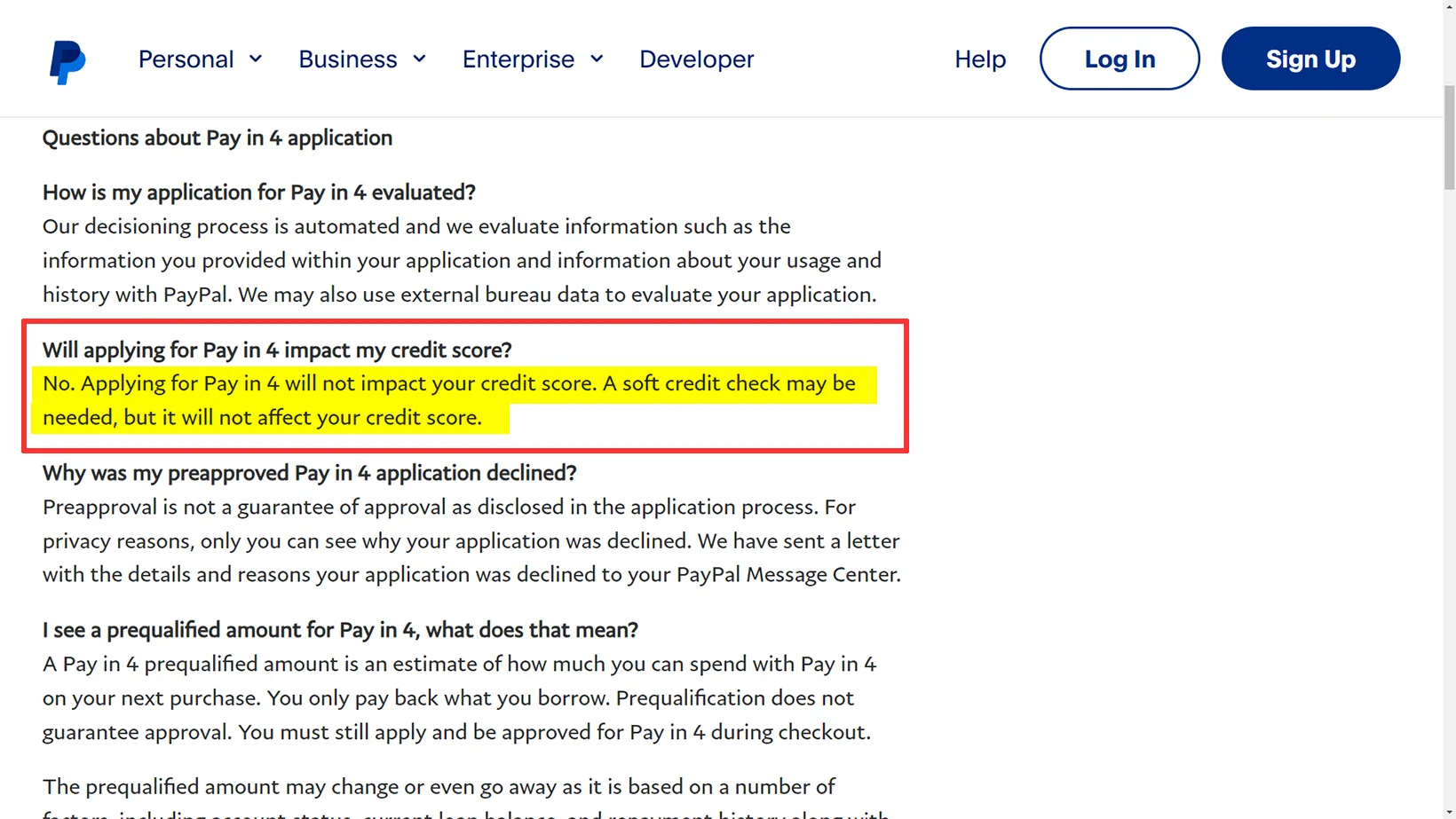

PayPal Pay in 4

PayPal’s Pay in 4 is one of the top services as it is interest-free, doesn’t do any hard checks, and doesn’t charge any late fees.

PayPal only does a soft credit check, which means they may check your score, but it doesn’t affect your total score.

As part of this check, they charge you a 25% payment upfront and sometimes check your bank account balance.

It does not do any hard checks if you can’t pay back on time or are worried about your score.

If you don’t pay on time, PayPal may limit your Pay in 4 account, but it won’t affect your PayPal account and your credit score.

Soft vs. hard credit check

According to Credit Karma, a soft check is when the lender checks your score but they don’t contribute to it. If you are in a difficult position with the lender, they won’t report it to credit departments.

A hard check is when the lender reports your score. This happens with interest-based loans such as home loans, buy now, pay later loans that charge you interest, personal loans, etc.

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.