Zip Pay is a popular buy now, pay later app with no down payment giving you flexibility on payments.

However, some apps provide better features at less cost. If you are looking for those apps, here are the 8 best apps like Zip Pay this year.

Afterpay

Availability: US, Canada, Australia, New Zealand, UK, France, and Spain

Expected limit: $350

Credit check: Soft Check

Late fee: $10 (can be up to 25% of the order)

Afterpay is the direct competitor of Zip Pay, supporting over 17,000 stores in the US.

It does not provide the option to use it wherever you want, but it is one of the first buy now, pay later apps having connections with almost all the major brands.

Initially, you get six weeks to pay, but as you use the app and gain more rewards, you can score up to 8 weeks.

To pay online, you sign in with your account, whereas a card can be generated to pay in-store.

Klarna

Availability: US, UK, Canada, Australia, New Zealand, and Many Countries in Europe

Expected limit: $350 to 1,000

Credit check: Soft check

Late fee: Varies by region

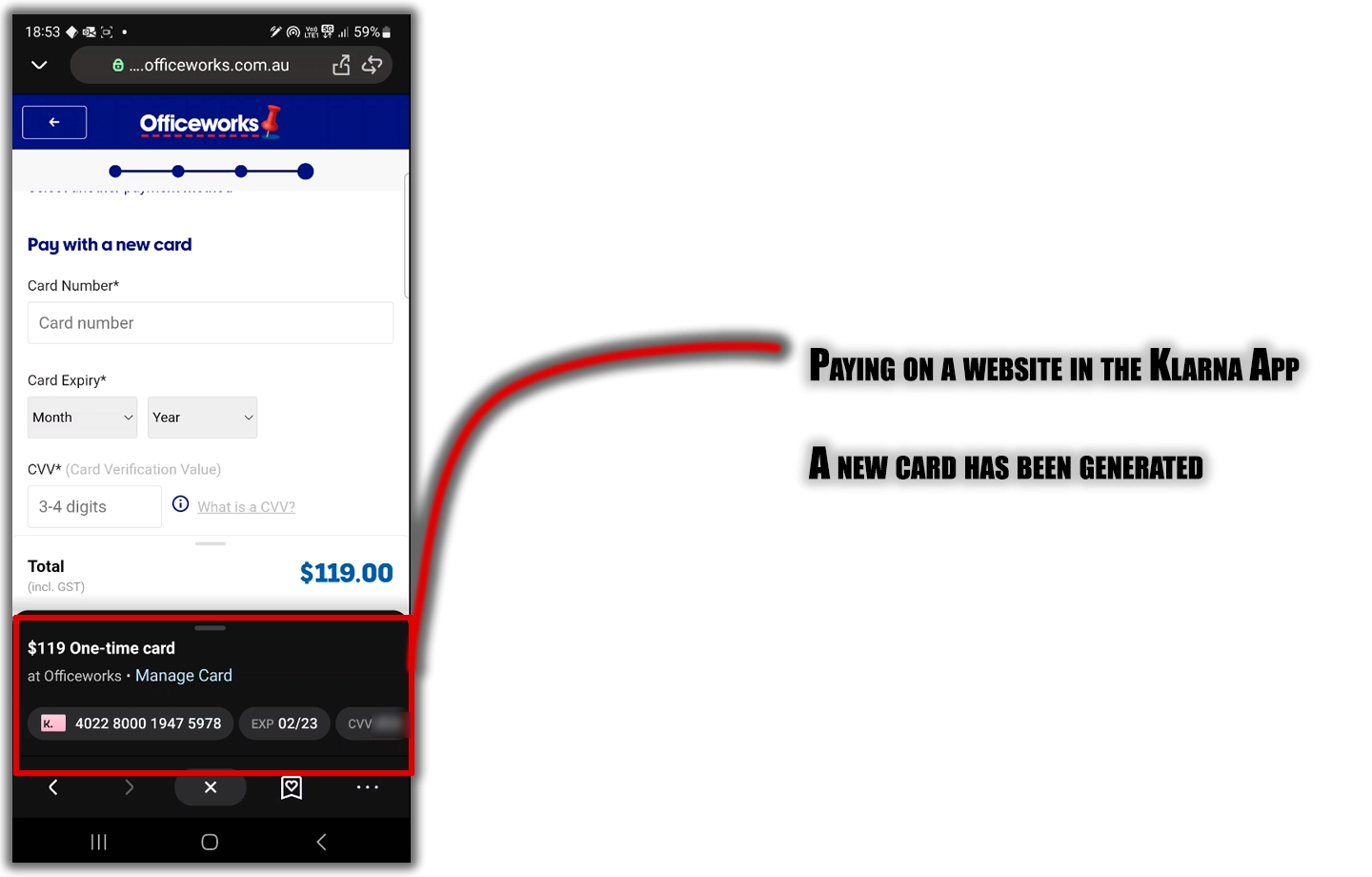

Klarna is another app like Zip Pay. It offers you to purchase from local stores that accept credit cards.

It lets you shop anywhere (except for some store types) and pay in four payments.

The first payment is on the day of the purchase, and the last is in the sixth week. The app creates a one-time card to use, which expires after use.

One of the best things about Klarna is that if you can’t pay back, you can request to get more days by paying a very tiny fee ($3 in Australia).

Related: Klarna vs. Afterpay

Sezzle

Availability: US and Canada

Expected limit: $500

Credit check: Soft check

Late fee: $10

Sezzle is available in the US and Canada, taking a simple approach. You pay the first payment on the purchase day; the remaining three are every fortnight.

According to the website, over 47,000 stores support Sezzle. The app supports both in-store and online shopping.

PayPal Pay in 4

Availability: US, Australia, and others

Limit: –

Credit check: Soft check

Late fee: No late fee

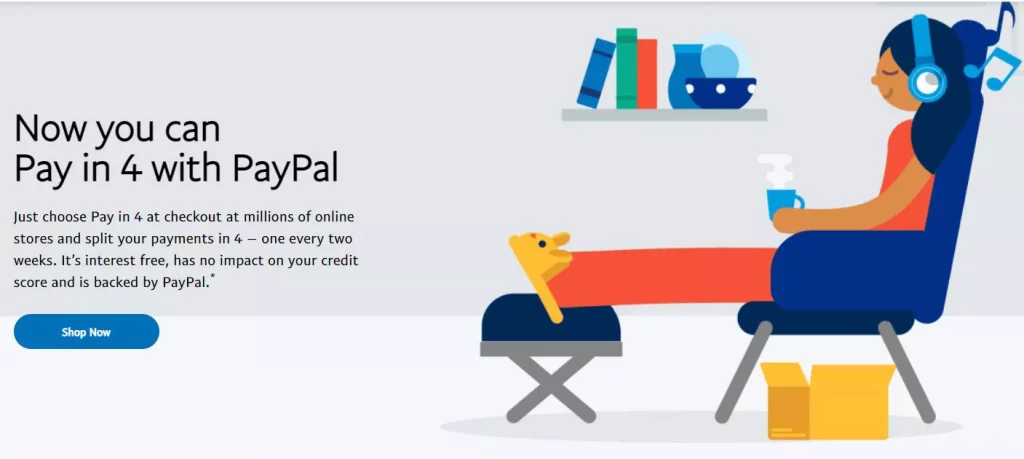

PayPal’s Pay in 4 is an easy way to shop in your favorite stores. It’s one of the apps like Zip Pay, offering both full and split payment options.

PayPal already has an edge because over 7 million sites accept PayPal. Also, Pay in 4 does not require additional information; you can use it if you have a PayPal account.

Related: Klarna vs. PayPal

Affirm

Availability: US & Canada

Expected limit: $500 – $3,000

Credit check: Soft and hard checks

Late fee: No late fee (it affects the account’s credibility)

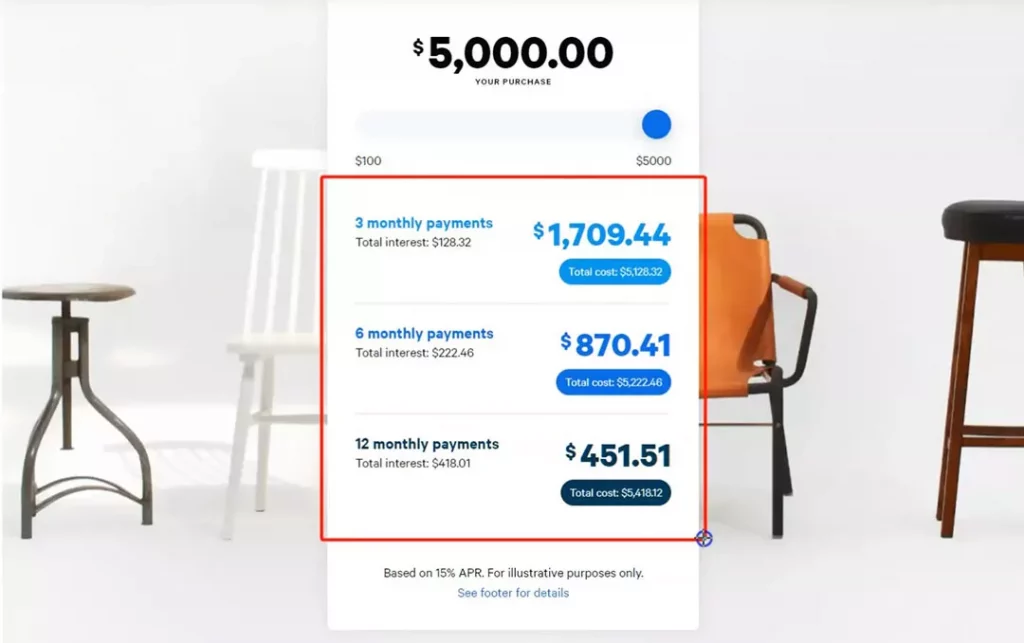

Affirm’s approach is like Zip Pay. It generates a card that works about everywhere where Visa is accepted.

The basic Affirm option has a fortnight feature with automatic payments, but if you can’t make the payments, you can go with the monthly option.

The monthly feature is for big purchases giving you up to 12 months to pay. However, you are charged interest. Their website has a calculator to see how much you will be paying.

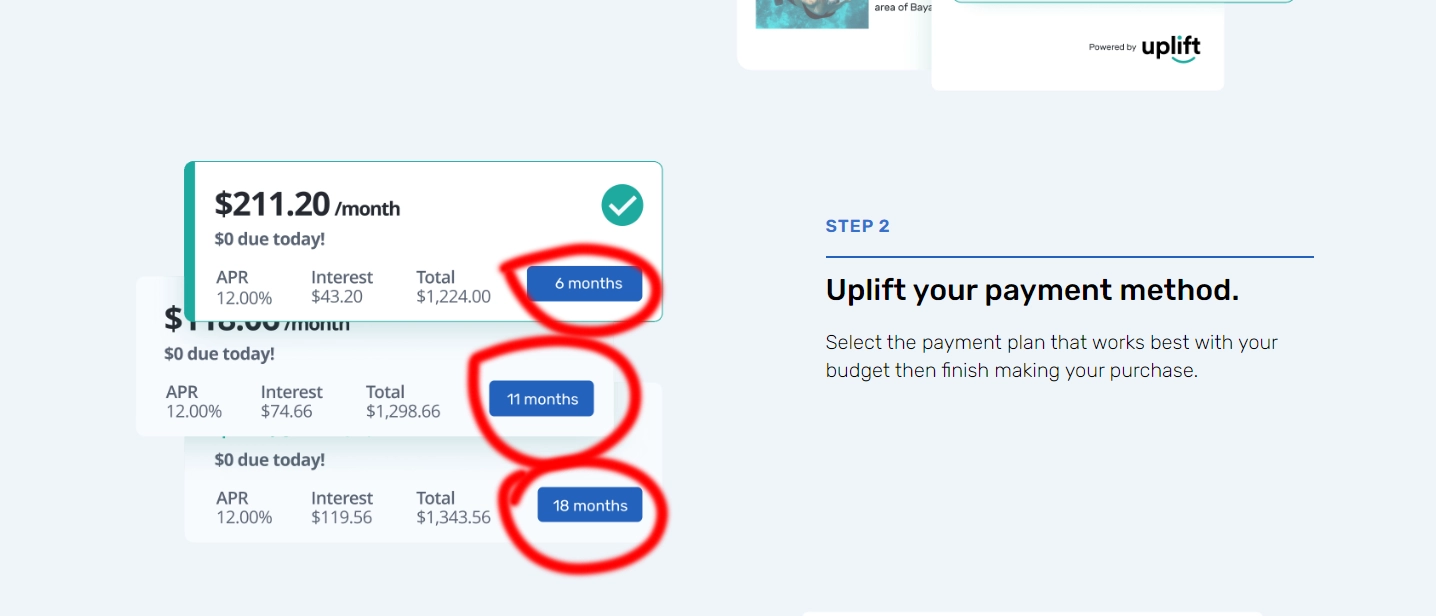

Uplift

Availability: US

Expected limit: –

Credit check: Soft and hard checks

Late fee: No late fee

Uplift has no down payment, making it one of the best apps like Zip Pay. It also gives you up to 18 months to pay.

You can choose the payback period, and there is no account fee. However, it charges you internet on the remaining amount.

Uplift is more for expensive things where you can’t afford to pay now and need the item quickly.

Sunbit

Availability: US

Expected limit: Up to $10,000

Credit check: Soft and hard checks

Late fee: No late fee, but interest applies if the account is unpaid

The second last Zip alternative is Sunbit. It takes the high road of giving you up to 12 months to pay. You choose the payment plan to suit your needs.

It checks your credit history before giving you any limit, but you can get up to $10,000 to shop in stores. It does not charge any late fee, but you pay the interest if you miss a payment.

Perpay

Availability: US

Expected limit: Varies

Credit check: Soft and hard checks

Late fee: None (but affects credit report)

Perpay is on a mission to help build your credit score. As you use the app, they keep track of your record and send them to the authorities.

Also, the app has a slightly different system. You set the payment terms, and your first payment is the day of your pay, so you don’t have to worry about not having enough money while shopping.

They also don’t charge late fees. If you miss multiple payments, your credit score will be affected.

Apps Like Zip Pay: Conclusion

These were the best similar apps to Zip Pay. I hope the article helped you to decide. Please let me know your thoughts in the comments below and subscribe to the newsletter for future updates.

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.