I have written multiple articles on buy now, pay later apps but never compared Klarna vs. Sezzle. Both are popular, and although there are a few differences, both are doing pretty well.

So, let’s find out who is the best in this battle.

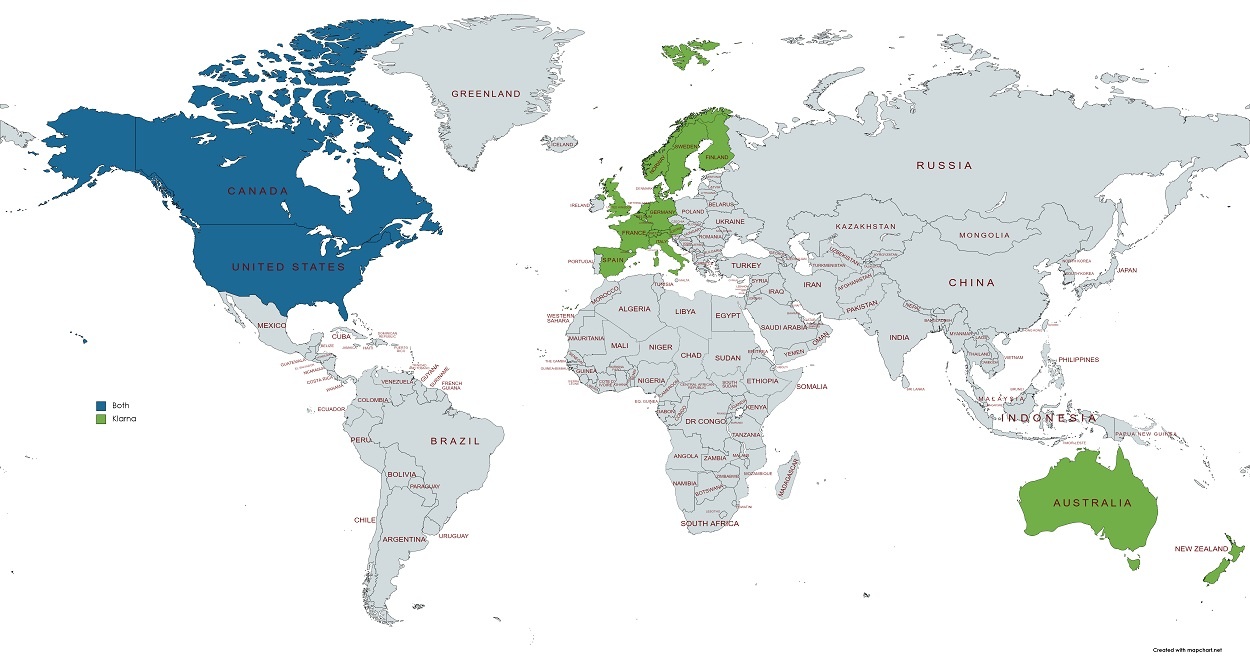

Availability

Klarna is available in over ten nations. Some of the countries where Klarna is available:

- Australia

- United Kingdom

- United States

- Canada

- Some countries in Europe

Sezzle, on the other hand, is only offered in the US, but merchants from other countries can sign up for the service. Over 47,000 stores support Sezzle.

Signing up

Klarna may offer options to sign up with local brands. For instance, people can sign up and use their Commonwealth Bank account in Australia.

You still require all the necessary details, including:

- Card or bank account details

- Phone number

- Date of birth (age verification)

- Email address

The first steps are to create the account, while the repayment information is provided later before making the first purchase.

Sezzle also asks for the same type of data. The first action is to verify the phone number. Once done, you are asked to give the following:

- Email address

- Card or bank details

- Verified ID

- Date of birth

Credit check and affect

Both Klarna and Sezzle do a soft credit check that does not affect your score but gives both businesses an idea of your overall score.

Related: Klarna vs. Afterpay

How do both work

Klarna

Klarna works everywhere where Visa is accepted (excluding some store types).

The Klarna app is integrated with a browser in which you can visit websites to shop. While visiting, an option called Pay with Klarna appears at the bottom.

As the app is a browser, you must log in with the store’s account. For example, you must sign in with your eBay account while shopping on eBay.

On the checkout page, you create a one-time Klanra card with the pay button and use it to pay.

If you want to use the app in-store, you can generate a digital card to add to Google or Apple Pay. However, to use the card, you will need to:

- Open the Klarna app

- Tap on the in-store option

- Search for the store

- Insert the amount on the next screen

- Tap on the repayment method and confirm the repayment dates

- Use the card in Google or Apple Pay

A whole article is available if you want to learn to use Klarna.

Sezzle

In Sezzle, you will find the “Pay with Sezzle” option on the checkout page. Although the option is slowly being replaced by the virtual card method, you still find it on some websites.

The virtual card can be added to Google to Apple Pay, but you need to apply for it in the app. Also, the card’s limit might be different from your maximum limit.

The virtual card works in limited stores (in-store), so you must ensure that the brand supports the card before using the card in-store.

Limits

The available limit is the next section of the Klarna vs. Sezzle comparison. Klarna does not show you your account’s limit, but you initially get around $300.

The company has said that depending on your account status; we can increase the limit.

The website also mentions that you can try purchasing an item more expensive than your maximum limit and see if the system grants the request. If it does, your limit will automatically increase.

Sezzle, on the other hand, comes with a $2500 limit, but before making the purchase, a few things are checked to ensure that you can pay back on time.

One of them is 25% of the order money upfront. You can also expect an increased limit after some successful repayments.

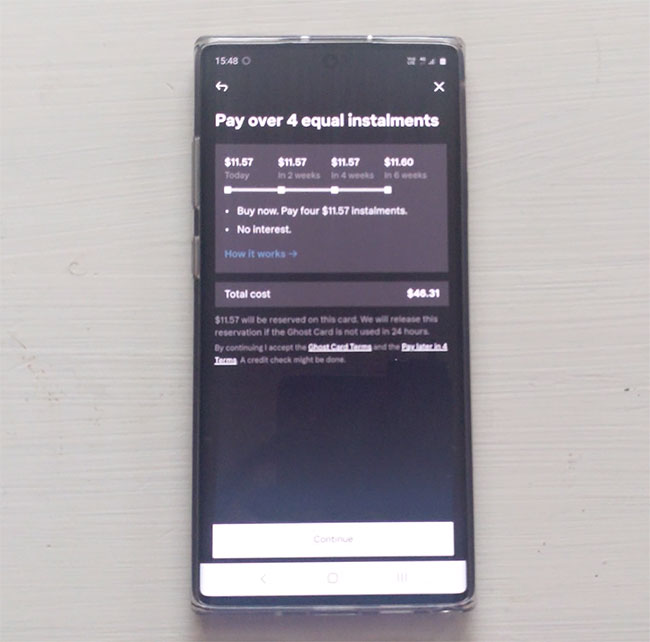

Repayments

Klarna offers six weeks to pay back. The first payment is on the day of the purchase, while the rest are every two weeks.

Sezzle works similarly and gives you six weeks to pay back. The first payment is on the day of the shop, while the rest are every fortnight.

Late fees

Klarna

Klarna is available in multiple regions, so the late fee is region-dependent. In Australia, the fee is between $3 and $15, depending on the total order value.

The table below is taken from the website and covers the late fee (Australian Klarna website).

| Order Value | Late Fee | Maximum Fee on Order |

|---|---|---|

| $0 to $59.99 | $3 | $9 |

| $60 to $99.99 | $5 | $15 |

| $100 to $199.99 | $7 | $21 |

| $200+ | $15 | $45 |

Sezzle

You may get two extra days to clear the payment if you miss a payment. The company charges a $10 fee, and your account is deactivated until you don’t pay it back.

Extend repayment date

Both allow you to change the repayment date if you can’t make the payment. Klarna charges you a couple of dollars fee to extend the due date.

Sezzle lets you reschedule one payment per order. If you can’t find the reschedule option, you have either used it or are not eligible.

Related: Afterpay vs. Sezzle

Klarna or Sezzle

From what we have discovered above, I suggest going with Klarna if you want an app to shop online.

It offers a decent amount of money, and you can spend on more stores than Sezzle. Sezzle is great and offers over $2000, but it is not available in as many stores as Klarna.

The third option I like is signing up for both and enjoying both on different occasions. For example, if one service offers some cashback on a particular store, use that one. It is a win-win decision.

Klarna vs. Sezzle: Links

Summary

The article Klarna vs. Sezzle compared many of their features. What do you think of both? Do you have any suggestions? Would you please share in the comments so we can discuss this further?

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.