The buy now, pay later industry is popular, and many services have emerged. Two of those are Afterpay and Sezzle.

Here is an Afterpay vs. Sezzle comparison to help you see the differences and choose the ideal service.

What are both

Both Afterpay and Sezzle and buy now, pay later apps to buy items and pay in four equal 25% payments in 6 to 8 weeks.

How do both work

Both work online and in-store. However, the usage is different.

Afterpay

Online

While shopping, you will see “Afterpay” at the checkout. Clicking on the button lets you log in with your Afterpay account.

Before the payment completes, Afterpay charges the first payment. You will also see your payment plan before paying.

In-store

The old barcode method is vanishing from stores. The new way to use Afterpay in-store is to generate a digital card and save it to Google Wallet or Apple Pay.

The card will be saved until you delete it, but you must go to the app and re-activate it before using it every time.

Buy now, pay later battle: Klarna vs. Sezzle

Sezzle

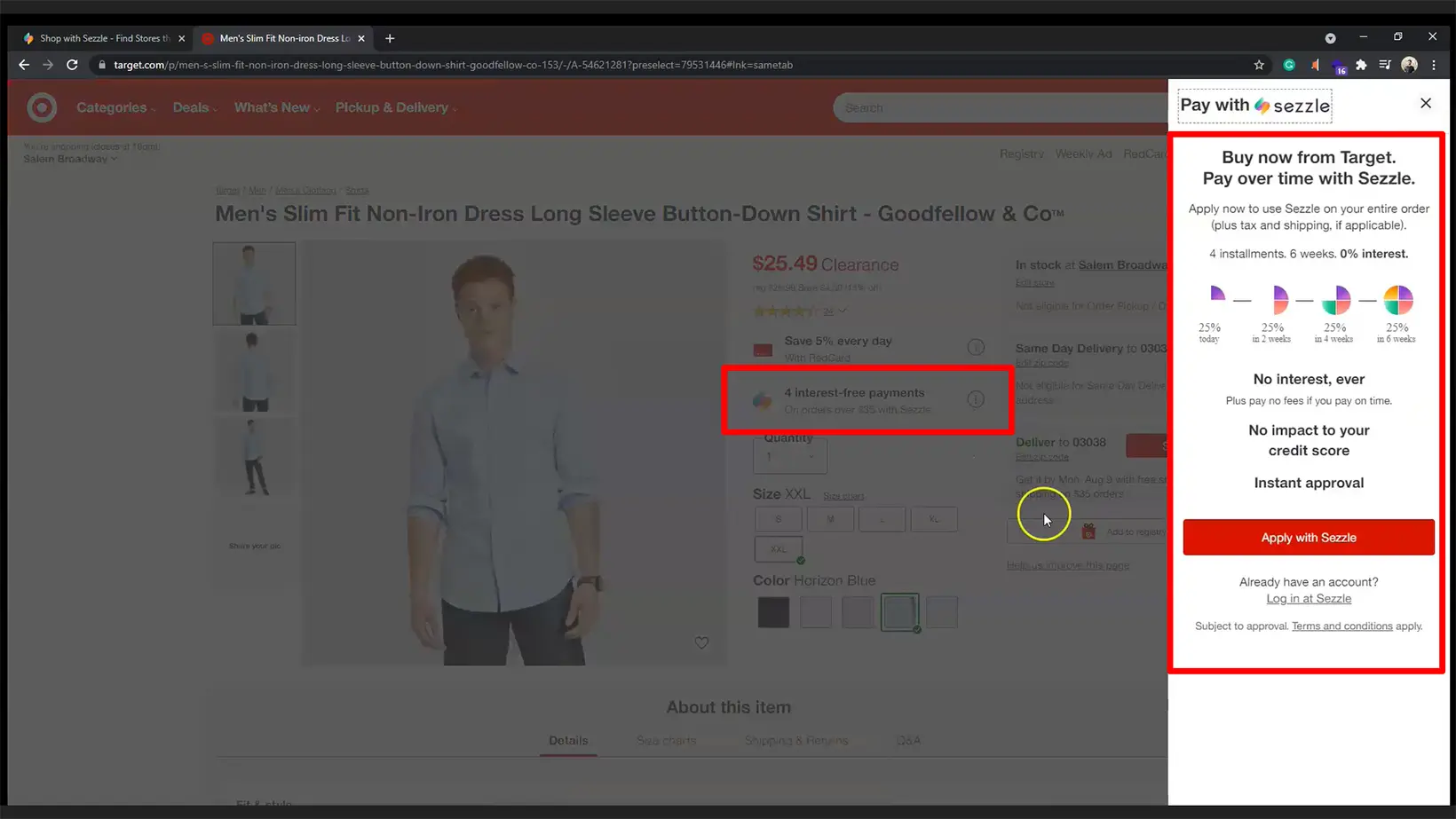

Online

The app works like Afterpay, where you find a supported store and select Sezzle at the checkout. Before paying, you must sign in with your Sezzle account to complete the necessary steps.

In-store

The company offers a virtual card to add to Google Wallet and Apple Pay to pay.

You might need to use Sezzle a few times to be eligible, and the card limit usually differs from the maximum limit. You can use the card in-store and even online.

Signing up

Starting with Afterpay, you need a few things. Here is the list:

- Email address

- Phone number

- Date of birth

- Credit, debit card, or a bank account

- Valid ID (requires in some locations)

Once you have provided those details, Afterpay charges a small amount to verify the payment method. However, the company does not check the credit score while signing up.

Sezzle also asks for a few things before offering the purchase limit. First, you provide your email, phone number, date of birth, and PIN.

The payment method (bank account, credit, or debit card) is added later as a further verification process. As for credit checks, Sezzle does a soft credit check before offering a spending limit.

Accessibility

Afterpay is available in five countries:

- Australia

- US

- UK

- Canada

- New Zealand

Sezzle is available in the US and Canada. Both offer iOS and Android apps for easier access. The Afterpay app also enables generating a barcode or an Afterpay card to shop in-store.

Both are offered on over 40,000 stores worldwide.

Afterpay vs. Sezzle: Limits

Afterpay gives you around $300 in the beginning. Depending on your location, it might be different. However, as you shop more, the limit increases.

The maximum limit with Afterpay is $1,500 to $2,000, depending on the region.

Sezzle offers around $200 initially, but like Afterpay, the limit increases as you go. The company offers up to $2,500 to spend.

Repayments

Both give you 6 weeks to pay. The first installment is charged before the purchase. This ensures that you have sufficient funds and a working card.

If you want an app without a down payment, please check out the best apps with no down payment guide.

Afterpay offers rewards, and the more you shop, the more rewards you get. On the top reward tier, you can score up to 8 weeks to pay.

On that level, you can also request a payment extension for the second or third payment without any additional fee.

Late fees

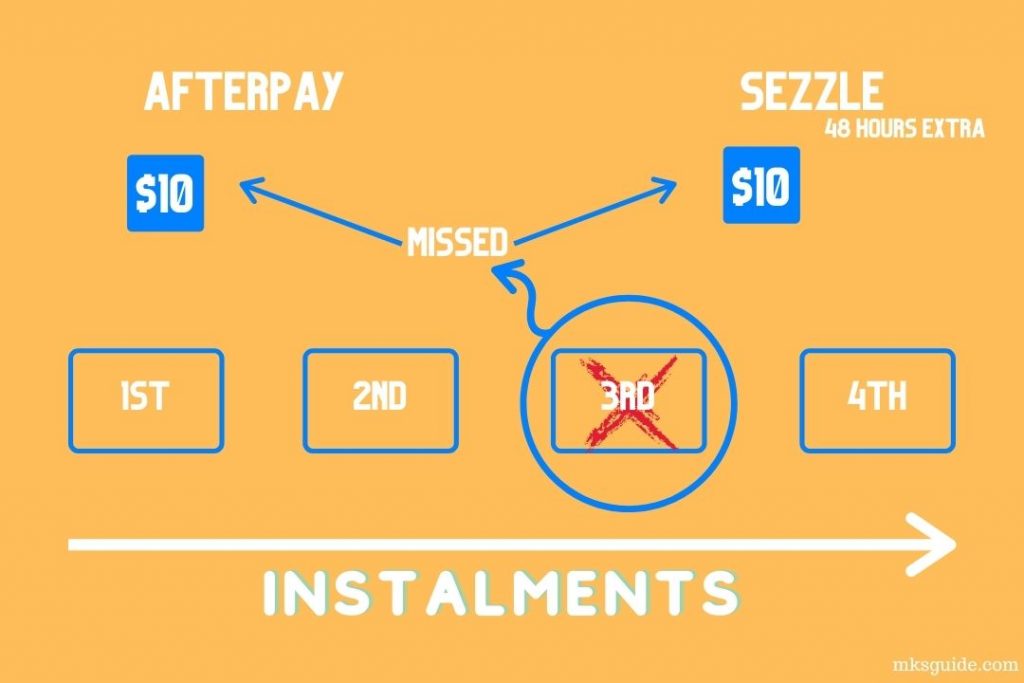

Afterpay charges a $10 late fee in Australia if the order value exceeds $40.

The fee switches to 25% of the installment if the order exceeds $40. The late fee gives you an additional seven days to pay. If you cannot clear the payment next week, you will be charged an additional $7.

Sezzle gives you two additional days to pay the fortnightly payment, but if you don’t make a payment, you are charged $10 in the US, and your account is deactivated until it returns to good standing.

A fine comparison: Afterpay vs. PayPal

Risks

Buy now, pay later may seem like an amazing way of shopping, but both Afterpay vs. Sezzle have risks.

One is that if you use those apps, it’s hard to calculate finances. The more payments you have to make, the more cautious you must be, as a late fee is something you don’t want to face.

Another issue is that you don’t know if you will have enough money to pay on time.

Furthermore, paying 25% at the time of the purchase feels good, so consumers tend to choose more expensive or more products.

This has happened to me, and I’m not sure many have experienced it.

Which one is for you

The whole comparison breaks down into stores, shopping types, and countries. If most of your favorite stores offer one but not the other, you should go with that.

Secondly, if you like an in-store option, Afterpay is the one to select. Finally, if only one is available in your nation, you don’t have any other choice.

Links

Summary

Both Afterpay and Sezzle are good if you pay back on time. Both have similar limits, repayment structures, and late fees.

I hope the Afterpay vs. Sezzle text helped. Let me know your views in the comments, and share the post with others to help them decide.

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.